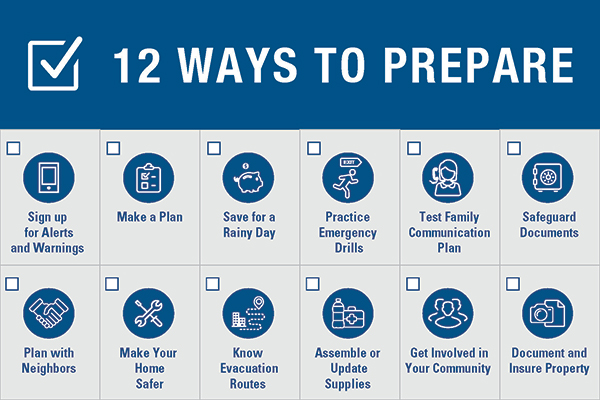

September marks National Preparedness Month, a time designated to help Americans be ready when disaster strikes. Ready.gov lists 12 ways to be prepared:

Michigan Schools and Government Credit Union can help you check a few items off your prep list.

Save for a Rainy Day

Whether you call it a rainy-day fund, contingency fund, emergency savings, or any other name, you can use your MSGCU account to help you save. MSGCU’s savings experts recommend creating a secondary savings account and naming it with whatever you choose to call your rainy-day fund. Add an account 24/7 in Online Banking or the MSGCU Mobile App (choose New Savings/Certificate, then secondary share).

You can then set up recurring transfers to fund your account, either in a lump sum or a little at a time. Even $5, $10, or $25 every payday adds up over time.

Document and Insure Property

Documenting what you own and the state of your property will save you a lot of hassle should you have damage from a disaster to your home or automobile. Plus, it’s important to understand your policy. Is your home or auto covered in the event of a flood, tornado, or lightning strike? Contact your provider so you know for sure, or you can review your policy documents.

If you’d like an insurance checkup, MSGCU works with two providers to help members save on their home and auto insurance:

Members Home and Auto®

Members Home and Auto offers exclusive insurance discounts and access to several reputable insurance companies like Citizens, Frankenmuth Insurance, AAA, Progressive, and more. All with just one contact. Call (800) 411-8709 or visit their website to get a free no-obligation proposal.

TruStage Insurance Program

TruStage works with Liberty Mutual Insurance to provide exclusive discounts for MSGCU members and excellent coverage for your home or vehicle. Call (855) 483-2149 or visit their website to get a free quote for property (like home or renter’s) or auto coverage.

Important reminders as you check your list

When safeguarding documents, many of us turn to electronic storage on a computer or in the cloud. Make sure to keep your sensitive information protected by saving only in secure locations, using complex passwords, and keeping your computer and electronic devices protected. See more tips in our recent cybersecurity blog post.

Many of us get involved in our communities by volunteering or donating to a charitable organization. Unfortunately, bad actors up their game when disaster strikes, creating fraudulent charities to trick well-meaning citizens in donating to their scam. Make sure to verify your money goes where you intend by checking the charity is legitimate before you give. View this flier from Michigan’s Attorney General for more tips on safe charitable giving.

MSGCU is here to help find ways for you to save for your emergency fund or put you in touch with a reputable provider to cover your personal property. And visit ready.gov for more resources to help you and your family be ready for whatever comes your way.

Members Home and Auto® is an independent insurance agency and resident agency of the State of Michigan. TruStage Auto Insurance program and TruStage Home Insurance program are offered by TruStage Insurance Agency LLC and issued by leading insurance companies. Discounts are not available in all states and discounts vary by state. The insurance offered is not a deposit and is not federally insured. This coverage is not sold or guaranteed by your credit union.

Sources:

https://www.ready.gov/low-and-no-cost

https://www.ready.gov/sites/default/files/2021-06/ready_12-ways-to-prepare_postcard.pdf

Category: Security

« Return to "Blog"