Curious about using your home's equity? A home equity loan or a home equity line of credit (HELOC) are two options that can help you fund home renovations, consolidate debt, and reach other financial goals. Let's explore these options and help you determine which might be the best fit for your needs.

What is Home Equity?

Home equity is your ownership stake in your home. It grows as you pay down your mortgage and your home's value increases.

How is it calculated?

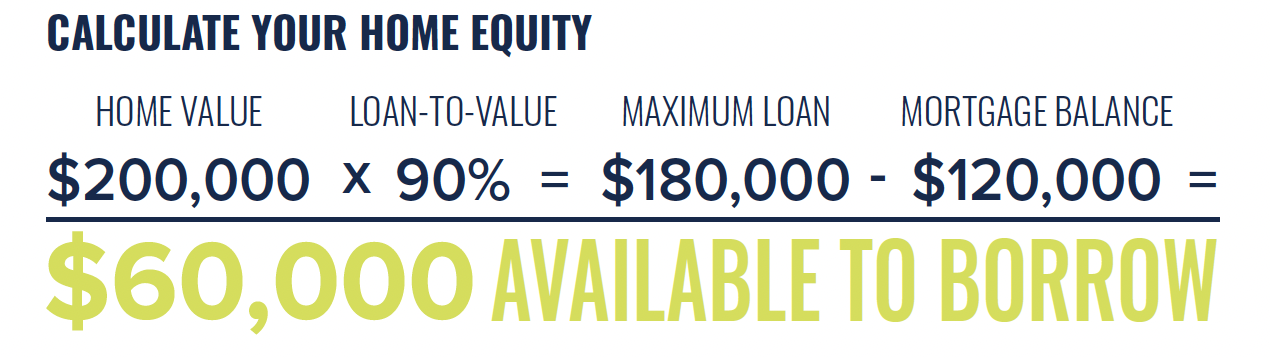

Your home’s equity is calculated by subtracting your mortgage balance from your home’s value (Home Value - Mortgage Balance = Home Equity). While many financial institutions allow you to borrow up to 80% of your home’s value, commonly referred to as a loan-to-value ratio, with MSGCU, you can borrow up to 90%. Here’s an example of how MSGCU calculates a home equity loan:

You can estimate your home’s equity with our financial calculator.

Benefits of using your home’s equity:

- Lower interest rates than most credit cards or personal loans.

- Potential tax savings on the interest you pay (consult your tax advisor).

- No prepayment penalty for new home equity loans and HELOCs from MSGCU.

What is a home equity loan?

A home equity loan is a loan that’s borrowed against your home’s equity. Your home’s equity is calculated as the difference between the current market value of the home and the outstanding balance on the mortgage.

Key features of home equity loans:

- Lump sum disbursement. Borrowers receive the full loan amount all at once.

- Fixed interest rate. Most home equity loans come with a fixed interest rate. At MSGCU, you can get a home equity rate as low as 6.49% APR* with no application fee.

- Set repayment terms. The loan is repaid over a predetermined period. MSGCU term loans can be repaid up to 15 years, with other financial institutions typically ranging from five to 15 years.

- Predictable payments. Borrowers know exactly how much they’ll pay throughout the life of the loan, making budgeting for the loan easy.

What is a Home Equity Line of Credit?

A home equity line of credit, also known as a HELOC, gives homeowners a revolving line of credit based on their home equity. You can draw funds as needed up to a set limit during the draw period. Afterwards, you enter the repayment period to pay back the borrowed amount plus interest. To help keep your initial payments lower during the draw period, you often only pay the interest on the money you've actually borrowed.

Key features of HELOCs:

- Revolving credit. Homeowners have access to a line of credit that can be drawn upon repeatedly during the “draw period,” which tends to last five to 10 years.

- Variable interest rate. HELOCs often have variable rates, which means the interest rate can change based on market conditions. Because of this, monthly payments can fluctuate throughout the HELOC term.

- Flexible repayment. Borrowers have the flexibility to pay off the balance and then re-borrow funds during the draw period.

- Interest-only payments initially. Many HELOCs allow interest-only payments during the draw period, making initial payments lower.

How are home equity loans and HELOCs used?

Although they are structured differently, HELOCs and home equity loans are generally used for similar purposes. While home renovation is usually the first thing that comes to mind, they can be used for other needs, such as debt consolidation, emergency expenses, and large purchases. Check out all the different ways you can use a home equity or HELOC loan in our blog post.

Key differences between HELOCs and home equity loans

Understanding the differences between these two products is crucial for deciding which is right for you.

1. Funding payout

- Home equity loans provide funds as a one-time lump sum. This makes them a perfect choice when you know the exact amount you need to borrow for a specific purpose. Examples include funding a major home renovation with a fixed contractor quote or consolidating high-interest debt into one loan.

- HELOCs offer a revolving line of credit that can be drawn as needed. This makes them ideal for homeowners who don’t know exactly how much they need to borrow. For instance, they are useful for funding home renovation projects completed in stages or paying for education costs over several semesters.

2. Interest rate structure:

- Home equity loans come with a fixed interest rate, which means there are no surprises throughout the life of the loan. This can mean significant savings for the borrower if interest rates rise.

- HELOCs have a variable interest rate, which can fluctuate with market conditions. This can mean having a lower monthly payment at times, and it can also lead to higher payments at other times.

3. Repayment terms:

- Home equity loans have a fixed repayment period with a set monthly payment.

- HELOCs feature flexible payment terms during the draw period. However, payments may vary once principal repayments begin.

Whichever home equity product you decide on, at MSGCU, you’re assured a market-leading rate, no application fee, and personalized guidance so you can pick the right loan for your needs. Call, video bank, make an appointment, or stop by one of our branches to learn more.

*Annual Percentage Rate (APR) may be higher, based on term of loan, credit score, collateral, and loan to value. Ask an MSGCU Representative for details. Example: A loan amount of $15,000 at 60 months with up to 80% Loan-to-Value and a rate as low as 6.25% (second lien) would be approximately $291.76.

Category: Finance

« Return to "Blog"