Farmington Hills Branch Office

Orchard Lake, North of 13 Mile

Orchard Lake, North of 13 Mile

With more than 150,000 members and a 97% satisfaction rating 20 years running, our team members are your financial advocates. From checking and savings, to loans and mortgages, to financial education and guidance, we provide valuable services you want and a team dedicated to getting you where you want to be.

29657 Orchard Lake Rd

Farmington Hills, MI 48334

Phone: (866) 674-2848 or (586) 263-8800

Monday – Wednesday: 9 am – 5 pm

Thursday – Friday: 9 am – 6 pm

Saturday: 9 am – 1 pm

Sunday: Closed

|

|

|

Tommie M. - Assistant Branch Manager Tommie joined MSGCU in 2023, bringing over 25 years of experience in the financial services industry. She holds a Associate's degree from Henry Ford College. Tommie enjoys getting involved with her local community and sharing her knowledge of financial literacy, including the importance of budgeting and saving money. "I knew joining MSGCU was the right choice for me when our values were perfectly aligned. I love that our common goal is to help our member and develop great relationships.” |

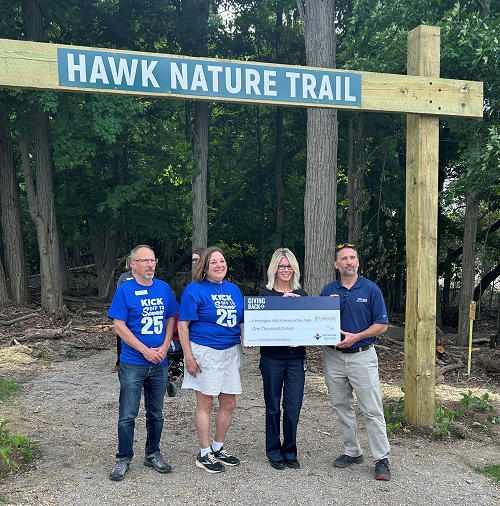

The Farmington branch team presented the MSGCU Giving Back donation to The Hawk Nature Trail. The donation will be used towards the creation of the new Hawk Nature Trail.

"It is a pleasure being part of a project that provides the community opportunities for recreation and enjoyment," said Debbie, MSGCU Farmington Hills branch manager. "Supporting the development of this nature trail promotes health, enhances quality of life and supports outdoor education for all ages in the community!"

§You must be at least 16 years old, and a member of MSGCU to participate in the Program. Referrals made to existing members of MSGCU are invalid. By making a valid referral that is completed by a Friend in accordance with the Program Terms, you and the Friend will each receive a cash reward as follows: $10 for a new MSGCU membership which is established by the Friend and remains in good standing for a period of at least 60 days; $25 for an approved and funded Auto, RV, Boat or Powersport loan of $5,000 or more applied for by the Friend within 10 days of membership open date; $25 for a new MSGCU VISA credit card which the Friend must apply for within 10 days of membership open date and be approved for within 30 days of application date; $100 for an approved and funded mortgage loan applied for by the Friend and funded within 180 days of membership open date; $25 for a new checking account opened by the Friend and funded with $25 or more within 10 days of membership open date. The Friend will receive an additional $25 reward if they make 10 debit card transactions of $10 or more via the new checking account within 60 days, or they receive a direct deposit of $100 or more into the account within 60 days. Only one reward per reward type is available, for each Friend referred, subject to a maximum of $1,500 in cash rewards per calendar year. Rewards will be automatically deposited into your oldest existing MSGCU primary share account two business days following confirmation by MSGCU that the referral has been made in full compliance with the Program Terms. Reward cash payments are considered interest and annual payments totaling $600 and above will be reported on IRS Form 1099-MISC, to federal, state, and local tax authorities, if required by applicable law. You are responsible for any taxes due. For full terms and conditions, visit https://www.msgcu.org/disclosures-and-fees.

Members and communities are at the center of everything that we do. Anyone in Michigan can bank with us, and we’re here to help all our members reach their financial goals.